Also, the average accounts receivable balance should only cover a certain period, just like how net credit sales are calculated. The company can then take the average of these balances, but it needs to be aware that daily transactions can change the average. Companies with more complicated accounting information systems may find it easy to get their average accounts receivable balance at the end of each day. This is usually found by taking the average of the beginning and ending balances of a company’s accounts receivable. The average balance of accounts receivable is used as the number in the ratio of accounts receivable turnover. Therefore, net credit sales are calculated as follows: Sales on credit – Sales returns – Sales allowances. Net credit sales are those in which the cash is collected later. But if returns happen in the future, this number should be added to the calculation because it has to do with the task being looked at. So, the net credit sales should only include a certain time frame (i.e., net credit sales for the second quarter only). Net credit sales are calculated by taking gross credit sales and subtracting these reductions.Ī consistent time frame must be used in the calculation. Net credit sales also include discounts or returns from customers.

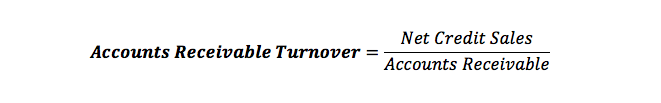

This number includes cash sales, which don’t affect accounts receivable. This is the amount of money a company earns that is paid for on credit. The number in the accounts receivable turnover ratio numerator is net credit sales. The following is the formula to determine your business’s accounts receivable turnover ratio. The ratio between net credit sales and average accounts receivable is called the accounts receivable turnover ratio. If the accounts receivable turnover ratio needs to be written into the business’s books, it must first be calculated. Allowing you to compare the accounts with those of other companies.Getting a sense of the average amount due for the year.Figuring out how well a business is at getting paid.Your company will benefit a lot from figuring out this ratio. The accounts receivables turnover ratio can be worked out once a year, thrice, or monthly. The ratio also shows how often a company’s receivables are turned into cash over a certain period.

The accounts receivables turnover ratio shows how quickly a business can collect its debts or the credit it gives customers. For example, if a company sells to a client, it could extend the terms by 30 or 60 days, giving the client 30 to 60 days to pay for the product.

INDUSTRY STANDARD ACCOUNTS RECEIVABLE TURNOVER HOW TO

How to Figure Out Accounts Receivable Turnover Ratio?Īccounts receivable are like short-term, interest-free loans that companies give their customers.

0 kommentar(er)

0 kommentar(er)